Condo Status Certificate: The Document That Can Save You Thousands

What Is a Condo Status Certificate in Ontario (and Why It Matters Before You Buy)?

Condo listings are built to show you the highlights: the view, the kitchen, the amenities, the lifestyle. But if you’re buying a condo in Ontario, Alberta or any other province, the Status Certificate is the document that tells you what you’re really buying.

It’s not exciting — but it’s often the difference between a confident purchase and a surprise bill you didn’t see coming.

If you’re in Alberta (Calgary), the concept is similar but packaged differently (often a condo document package with an estoppel certificate, financials, bylaws, reserve fund study, etc.). The principle is the same: don’t buy a condo without reviewing the building’s financial and legal reality.

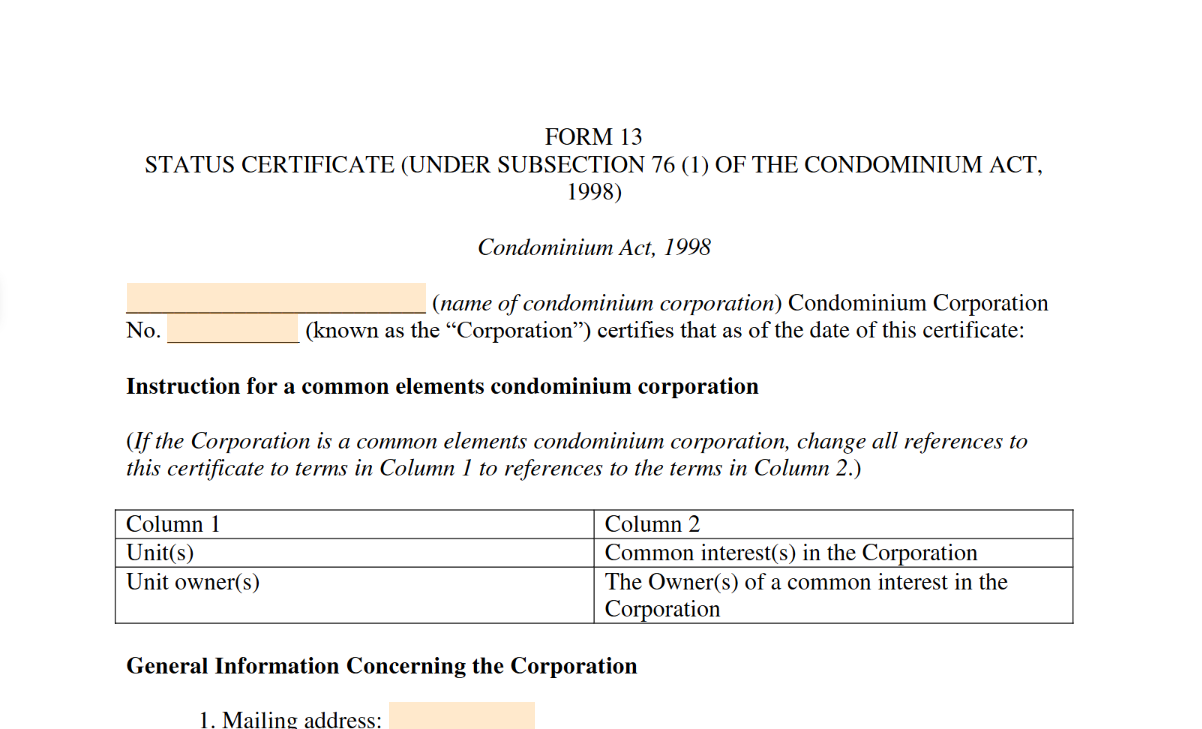

What is a Status Certificate?

Think of the Status Certificate as the condo corporation’s financial + legal report card. It’s a standardized package of documents that helps you understand:

The building’s financial health

Known legal issues

Rules and restrictions that affect how you can use the unit

Potential costs that may be passed on to owners

This is why buyers commonly include a Status Certificate condition in the offer: it gives your lawyer time to review the package and confirm there are no deal-breaking issues.

Why it matters (even when the unit looks perfect)

A condo can show beautifully and still be attached to building-level issues that impact:

Your monthly costs (condo fees rising, special assessments)

Your resale value (lenders and buyers get cautious with “red flag” buildings)

Your flexibility (rental restrictions, pet rules, renovation limits)

Your risk (lawsuits, insurance problems, governance issues)

The listing won’t necessarily highlight any of that — because most of it isn’t about the unit. It’s about the corporation behind it.

The biggest items the Status Certificate can reveal

1) Reserve fund strength (the building’s savings account)

The reserve fund is what pays for major repairs: roofs, windows, garages, elevators, mechanical systems, and other big-ticket items.

A strong reserve fund usually means the building has been planning and saving properly. A weak reserve fund can mean future repairs get funded through:

Higher condo fees, or

Special assessments (one-time bills to owners)

2) Special assessments (surprise bills)

Special assessments are one of the most painful surprises in condo ownership. Even a well-managed building can have them — but patterns matter.

A careful review looks for:

Whether any special assessments are already approved

Whether major projects are coming with unclear funding

Whether owners have been “cash-called” recently

3) Legal issues and lawsuits

Not every lawsuit is a disaster — but litigation can impact:

Financing (some lenders get cautious)

Insurance premiums

Buyer confidence at resale

Your lawyer’s job is to interpret what the dispute is about and how serious it is.

4) Budget health and owner arrears

If a building has a growing number of owners behind on payments (arrears), it can strain the corporation’s cash flow and push costs onto everyone else.

5) Rules & restrictions (this is where lifestyle + investor plans can break)

This part gets missed constantly because buyers assume “we’ll figure it out later.”

Common restrictions include:

Rental rules (minimum lease terms, caps, approval requirements)

Short-term rental bans

Pet restrictions (size, breed, number of pets)

Renovation rules (noise hours, approvals, flooring requirements)

Use-of-unit rules (home businesses, BBQs, storage, balconies)

For investors, rental restrictions can directly affect demand, tenant quality, and income stability. For end-users, rules can be a deal-breaker for lifestyle.

6) Insurance and risk flags

Insurance costs have been a big issue in many markets. Your lawyer may look for signs that the corporation has:

Unusual insurance issues

Claims history concerns

Coverage gaps that increase owner risk

(Exact interpretation depends on what’s disclosed in the package and what your lawyer flags.)

Investor lens: what matters most

If you’re buying as an investment, the Status Certificate isn’t “extra paperwork” — it’s a risk screen.

Pay close attention to:

Reserve fund adequacy (fees and assessments affect cash flow)

Upcoming projects (repairs can hit cap rates indirectly)

Rental restrictions (future exit liquidity matters)

Litigation and insurance concerns (financing + resale impact)

Fee trends (are increases consistent and reasonable, or spiky and reactive?)

A building with great finishes but unstable finances can turn an “A+ unit” into a mediocre investment.

End-user lens: what matters most

If you’re buying to live in it, you want predictable costs and minimal drama.

Focus on:

Fee stability and what’s included

Quality of management and governance (patterns matter)

Rules that affect your day-to-day (pets, renovations, noise, balconies)

Major projects that could disrupt living (garage repairs, elevator modernization, etc.)

A simple Status Certificate checklist (what to ask your lawyer to confirm)

Here are practical questions you can use when reviewing:

Is the reserve fund appropriate for the building’s age and upcoming projects?

Are there any planned or likely special assessments?

Are there lawsuits or claims that materially affect risk or financing?

Are condo fees trending normally — and what do they include?

Are there any warning signs in the budget or arrears?

Do the rules align with my intended use (pets, rentals, renovations)?

Are there unusual insurance concerns or exclusions?

Are there governance issues that keep repeating (owner disputes, chronic underfunding, etc.)?

Is there anything that could affect resale value or buyer confidence later?

Overall: would your lawyer consider the building “healthy” relative to comparable condos?

The takeaway

A condo can look perfect — but the Status Certificate tells the real story.

The best approach is simple:

Always have it reviewed by a lawyer

Ask questions until the risks are clear

Never rush this step

If you’re currently buying (or thinking about buying) and want help spotting what matters before you firm up, send me a message. I’ll help you structure the right conditions and make sure you’re reviewing the building properly — whether you’re buying for yourself or as an investment.

Niesh Dissanayake

@nieshwealthbuilder